Our Services

Investments Portfolio

There Are Basically 6 Common Types of Portfolios.

- Conservative portfolio.

- preservation portfolio.

- Aggressive portfolio.

- Appreciation portfolio.

- Income portfolio.

- Socially responsible portfolio.

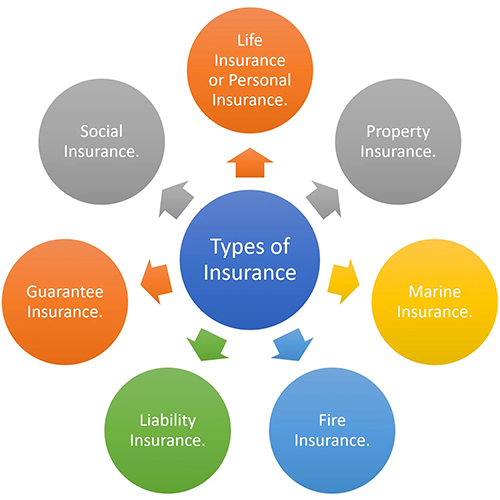

Insurance Portfolio

Types of General Insurance – Individuals:

- Motor Insurance

- Travel Health Insurance

- Personal Accident

- Home Insurance

Retirement

- Stage 1: Pre-retirement.

- Stage 2: The honeymoon phase.

- Stage 3: Disenchantment.

- Stage 4: Re-orientation and finding yourself.

- Stage 5: Stability.

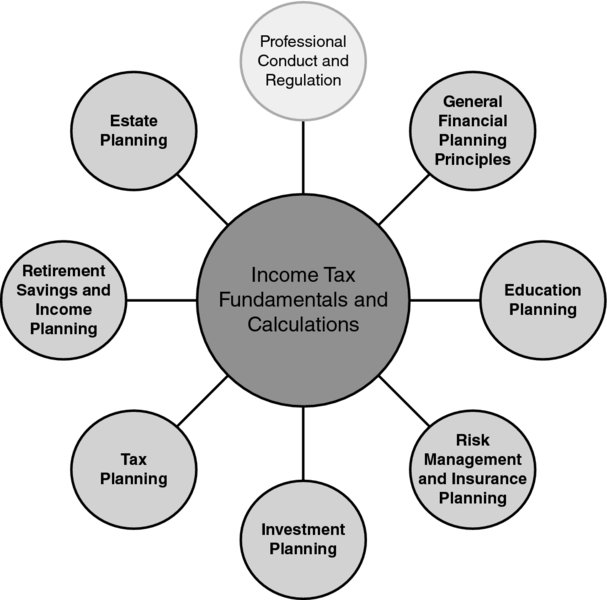

Tax Fundamental

The services are very helpful if you are :

- A senior citizen: who wants to maintain independence and stop worrying about paper works

- A busy professional: who want to focus more on the day-to-day tasks rather than worry about papers, bills, mails, and other administrative tasks

- A caregiver : who is trying to help a family member and stay organised

- A big family: where it is difficult to stay organised for taking care of all the documents and paper work

- A student : who is busy in the studies and can’t give enough time to the administrative work

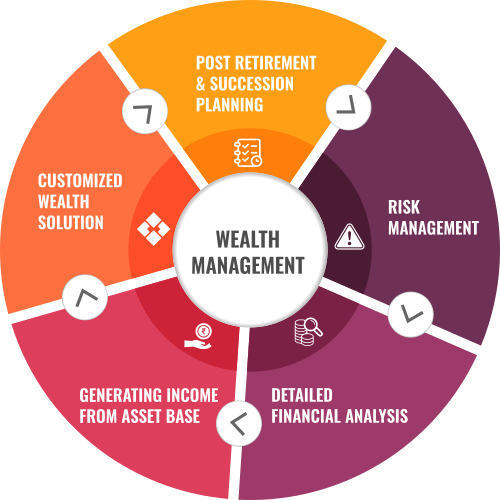

Wealth Management

Following are some of the important aspects of wealth management:

- Understanding Investment needs: Clarity of the investment needs should be of the utmost priority to set the direction

- Products and Services: Knowing the right products and services suitable for you will enable you to take the right decision to achieve your financial goal

- Advisory Services: Involving the professionals will enable you to take advantage of their professional experience and expertise

- Estate Planning: Estate Planning is also a very essential part of your wealth management as it ensures and preserves wealth for a longer term

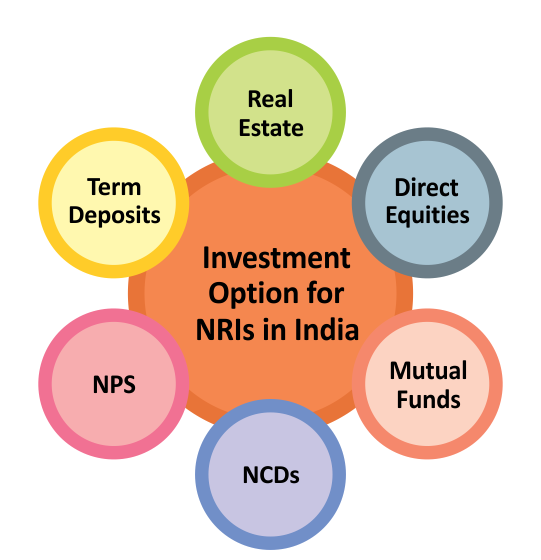

NRI Investments

The services are very helpful if you are :

- Determination of your residential status in India

- Interpretation of DTAA with a view to reduce tax liability in India

- Handling of issues relating to Inheritance, Will, etc.

- Compliances with respect to the Income-tax Act, 1961, Wealth-tax Act, etc.

- Application for Permanent Account Number (PAN)

- Filing of India Tax return

- Advising suitable tax saving investments

- Opening NRE,NRO and FCNR accounts

- And many more NRI services

Quick Links

Our Products

Contact Details

- info@aurobriddhimoney.com

- +91-9830048135

- 54/2/1 Central Road, Shyamnagar, Kolkata, West Bengal 743127

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments. Option of Direct Plan for every Mutual Fund Scheme is available to investors offering advantage of lower expense ratio. We are not entitled to earn any commission on Direct plans. Hence we do not deal in Direct Plans.

AMFI Registered Mutual Fund Distributor – ARN-85726 | Date of initial registration – 10 May 2005 | Current validity of ARN – 10 May 2027

Grievance Officer- Piyali Roy Chowdhury | 7679333192 | peu123k@gmail.com

Important Links | SID/SAI/KIM | Code of Conduct | Sebi Circular | AMFI Risk Factors